new haven mi taxes

Home Shopping Cart Checkout. Therefore a real estate property assessed at 10000 will pay 39750.

Michigan Property Tax H R Block

The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000.

. YEARS IN BUSINESS 586 749-9300. New Haven Township Treasurer. See home details and neighborhood info of this 4 bed 3 bath 2758 sqft.

This data includes a current and prior year overview comparison as well as charts and graphs that allow you to view trends over multiple years. All payments made online before 8 pm Monday-Thursday are uploaded posted on the next business day holidays excluded. Tax Return Preparation Bookkeeping Payroll Service.

Billys Bookkeeping Income Tax. New Haven Townships monthly board meeting will be held. 54111 Broughton Road 1st Floor Macomb MI 48042.

Congratulations New Haven Community Schools Celebrating 100 Years. The New Haven sales tax rate is. The current total local sales tax rate in New Haven MI is 6000.

You can also pay in person at the New Haven Township Hall on these dates. Michigan is ranked number eighteen out of the fifty states in order of the average amount of property taxes collected. The Municipal Performance Dashboard includes financial and operating measures important to the government and its citizens.

The minimum combined 2022 sales tax rate for New Haven Michigan is. Single family home located at 58187 Thomas Dr New Haven MI 48048. The December 2020 total local sales tax rate was also 6000.

Payments made by personal checks in office or by mail will have an automatic five 5 business day hold unless you provide proof of payment before that time. The December 2020 total local sales tax rate was also 6000. Revenue Bill Search Pay - City Of New Haven.

Winter tax bills are due February 14 2023 to avoid interest and penalty. Find Tax History Before You Buy. This data includes a current and prior year overview comparison as well as charts and graphs that allow you to view trends over multiple years.

Areas of focus include the following. The 6 sales tax rate in New Haven consists of 6 Michigan state sales tax. All payments made after 8 pm Monday-Thursday allow 48 hours to be.

Counties in Michigan collect an average of 162 of a propertys assesed fair market value as property tax per year. The Municipal Performance Dashboard includes financial and operating measures important to the government and its citizens. DMV Property Tax Unit.

Taxes current page CATEGORY. 2705 Easton Rd Owosso Mi 48867. View Cart Checkout.

This is the total of state county and city sales tax rates. Food and General Assistance. Saturday December 17 20229 am.

Michigans Adventures SMART Trip Event is Full read more. For mailed payments please send to. Its taken times the established tax levy which is the sum of all applicable governmental taxing-authorized entities levies.

This data includes a current and prior year overview comparison as well as charts and graphs that allow you to view trends over multiple years. Will pay a tax of 43880. Summer tax bills that were deferred are also due on this date.

Visit Our Website Today To Get The Answers You Need. The County sales tax rate is. Be Your Own Property Detective.

They range from the county to New Haven school district and various special purpose entities such as sewage treatment plants amusement parks and property maintenance facilities. The Municipal Performance Dashboard includes financial and operating measures important to the government and its citizens. Name A - Z Sponsored Links.

Tax Info. The Michigan sales tax rate is currently. The DMVs Property Tax Section may be reached by by phone at 860 263-5153 or by mail at.

Ad Search Local Records For Any City. The Municipal Performance Dashboard includes financial and operating measures important to the government and its citizens. Use Our Website To Search Records Now.

This data includes a current and prior year overview comparison as well as charts and graphs that allow you to view trends over multiple years. Areas of focus include the following. Taxes Calculator in New Haven MI.

Areas of focus include the following. Its taken times the established tax levy which is the sum of all applicable governmental taxing-authorized entities levies. 2021 Village of New Haven Water Report CCR read more.

If you received a tax bill for a vehicle not garaged in New Haven as of October 1 2021 contact the Assessors Office. Personal property and motor vehicle are computed in the same manner. Today RadDatePicker Open the calendar popup.

Account info last updated on Aug 16 2022 0 Bills - 000 Total. 65 results for Taxes near New Haven MI. City Of New Haven.

Areas of focus include the following.

Unfair And Unpaid A Property Tax Money Machine Crushes Families

Wall Street Quietly Creates A New Way To Profit From Homeowner Distress Center For Public Integrity

Property Tax Debt Scheme Minority Families Lose Homes To Money Machine Bloomberg

Property Tax How To Calculate Local Considerations

11 Ways The Wealthy And Corporations Will Game The New Tax Law Center For American Progress

11 Ways The Wealthy And Corporations Will Game The New Tax Law Center For American Progress

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

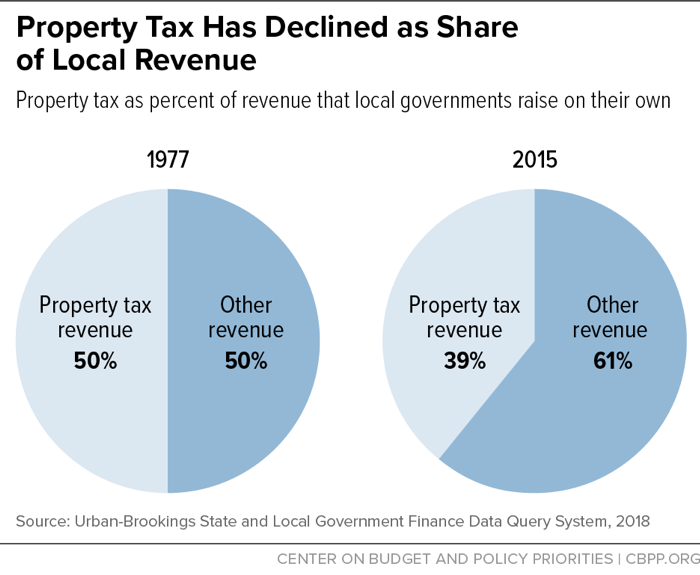

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

60 Fortune 500 Companies Avoided All Federal Income Tax In 2018 Under New Tax Law Itep

Meditation Studio Teacher Lia Jamerson Meditation Studio Meditation Scripts New Teachers

Tax Policy States With The Highest And Lowest Taxes

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

These States Have Suspended State Gas Tax Forbes Advisor

It S Tax Season Use Your Refund To Jump Start Your Down Payment Savings Tax Season Tax Refund Tax Time

Deducting Property Taxes H R Block

New Tax For Digital Payments No But Big Changes May Be Coming Findlaw